The PAN Card New Rule 2026 has introduced a major and important change by the central government, which will directly affect crores of PAN card holders across the country. The Income Tax Department is implementing new rules to make the PAN card more secure, digital, and transparent. The main objective of these changes is to prevent tax evasion, stop fake PAN cards, and connect all financial transactions to a strong and reliable system. If you already have a PAN card or are planning to apply for a new one, this information is very important for you.

What is PAN Card New Rule 2026

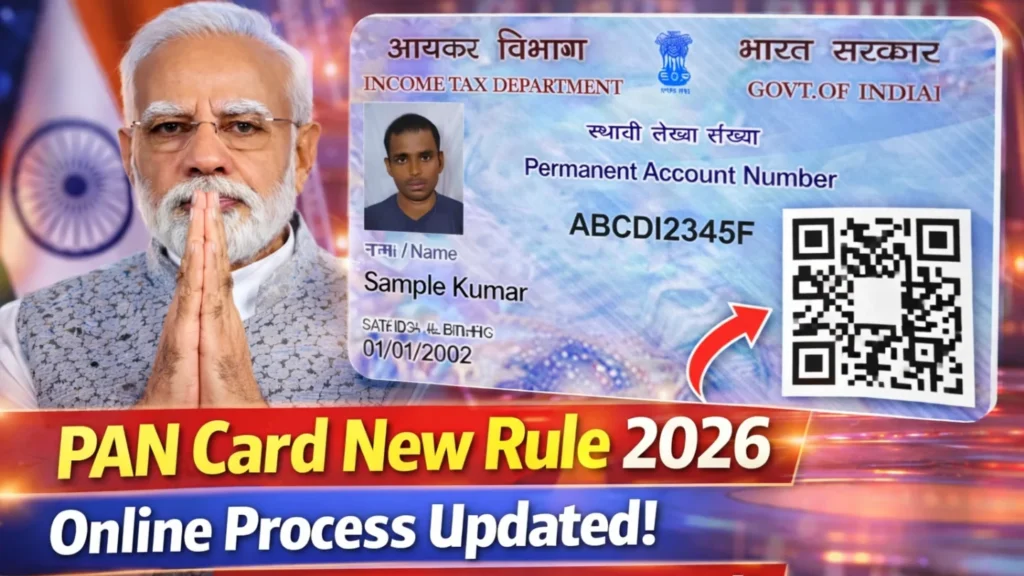

Under the PAN Card New Rule 2026, the PAN card is being developed as a completely digital and smart identity document. According to the new rules, linking the PAN card with Aadhaar has become more mandatory and strict than before. Along with this, a new PAN Card 2.0 system will be implemented, which will include features like QR code, digital verification, and real-time data updates. The government believes that this will make the tax system more transparent and efficient.

Read More: SBI Minimum Balance Rule Change 2026, New Penalty – Check Minimum Balance Requirement

Aadhaar and PAN Linking Made Mandatory

As per the new rules, linking the PAN card with Aadhaar will be completely mandatory from 2026. If a PAN card is not linked with Aadhaar, it may become inactive. An inactive PAN card cannot be used for banking services, filing income tax returns, investments, or any major financial transactions. Therefore, the government has advised all citizens to link their Aadhaar and PAN cards within the given time.

New Features in PAN Card 2.0

Under PAN Card 2.0, the new PAN card will be much more advanced than before. It will include a high-security QR code, which will allow instant verification of the PAN card anywhere. The QR code will securely store details such as the holder’s name, date of birth, and PAN number. Due to this advanced security, creating fake PAN cards will become almost impossible. This new system will also strengthen the Digital India mission.

Changes in the Process of Applying for a New PAN Card

After the PAN Card New Rule 2026, the process of applying for a new PAN card will become easier but more strict. While applying online, Aadhaar-based e-KYC will be mandatory. Without proper identity verification, a PAN card will not be issued. This step will help stop people from applying for PAN cards using false information. The positive aspect is that applicants with correct documents will receive their PAN cards much faster.

What Existing PAN Card Holders Need to Do

If you already have a PAN card, there is no need to panic, but you must complete a few important steps. First, make sure that your PAN card is linked with your Aadhaar card. Second, ensure that details like your name, date of birth, and other information on the PAN card match your Aadhaar details. If there is any mismatch or error, it is important to get it corrected immediately to avoid future problems.

Impact on Tax and Banking Services

The PAN Card New Rule 2026 will have a direct impact on tax filing and banking systems. All major financial transactions such as bank accounts, loans, investments, property purchases, and stock market activities will be monitored more strictly. This will help control tax evasion and benefit honest taxpayers. According to the government, these changes will make the country’s financial system stronger and more reliable.

Why This New Rule is Important

The government has implemented the PAN Card New Rule 2026 to make the financial system of the country more secure and transparent. Fake PAN cards and incorrect identity details were causing huge losses to the government every year. The new rules will help control these issues to a large extent. At the same time, tax and banking-related processes will become safer and easier for common citizens.