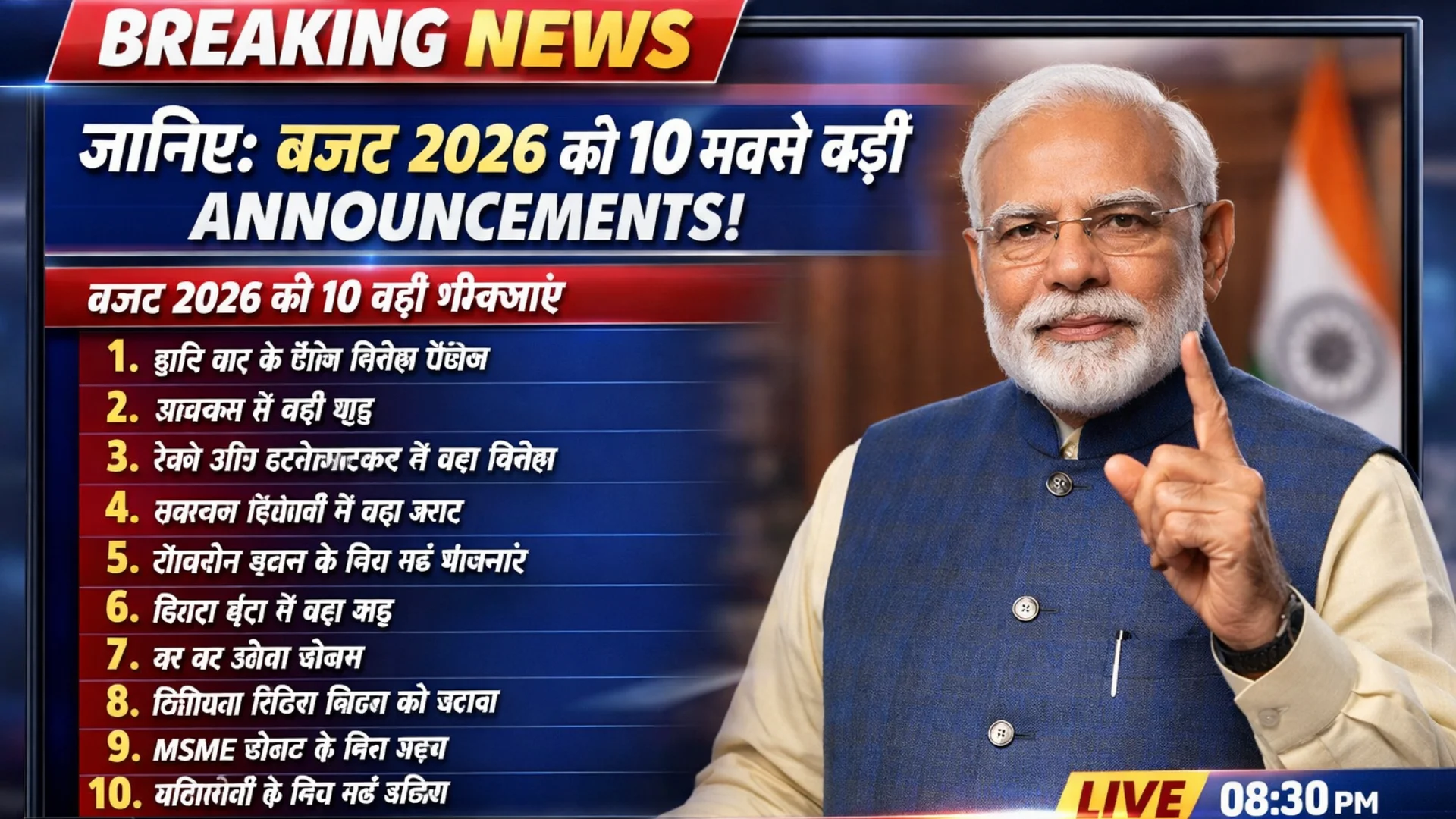

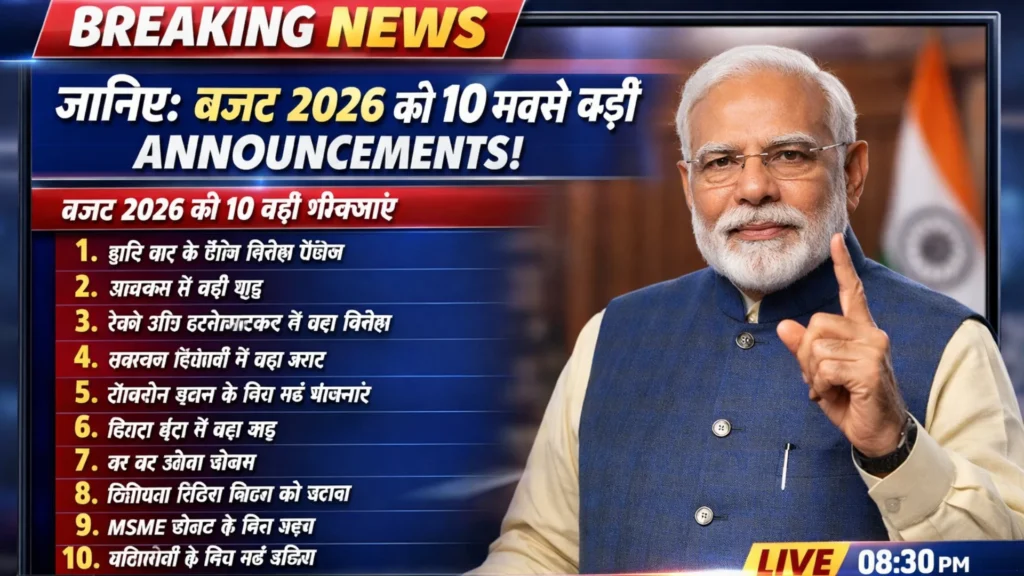

The eyes of crores of people across the country are fixed on Budget 2026. As every year, this time too the general public, salaried employees, traders, and farmers all have high expectations from the budget. Especially regarding income tax and petrol diesel prices, there is a lot of curiosity among people. Under Budget 2026 live updates, the government has taken several important decisions that will directly impact the pockets and daily lives of common citizens.

Major Relief Expected on Income Tax

In Budget 2026, the government has placed strong focus on income tax. It is believed that changes have been made to tax slabs to provide relief to the middle class. The new tax system has been made simpler so that taxpayers face fewer complications. Decisions such as increasing the standard deduction and raising tax exemption limits may directly benefit salaried individuals.

Important Changes in the New Tax Regime

The new tax regime has been made more attractive in Budget 2026. The government aims to bring more people under this system. Emphasis has been placed on lower tax rates and simplified rules. This is expected to provide major relief to young earners and new taxpayers. The government believes this will also improve tax collection.

Big Announcement on Petrol and Diesel Prices

Budget 2026 live updates also include a major decision regarding petrol and diesel. Considering rising inflation, the government has indicated some relief in taxes levied on fuel. If this decision is fully implemented, a reduction in petrol and diesel prices may be seen. This will lower transportation costs and also help control inflation.

Government Focus on Controlling Inflation

One of the main goals of Budget 2026 is to control inflation. Prices of food items and daily necessities had been rising continuously. The government has proposed measures in the budget to strengthen the supply chain so that essential goods are available at lower prices. This is expected to provide relief to common people.

Announcements for Farmers and Rural India

Budget 2026 also includes several important announcements for farmers and rural areas. New schemes and subsidies have been announced to strengthen the agricultural sector. Special attention has been given to irrigation, crop insurance, and rural infrastructure. This may also increase employment opportunities in villages.

Relief for Salaried and Middle Class

This budget has taken into account the needs of salaried and middle class families. Along with income tax relief, focus has also been given to housing and education related expenses. Benefits such as affordable home loans and interest relief on education loans can provide direct financial relief.

Infrastructure and Development योजनाएं

According to Budget 2026 live updates, the government has made a major push towards infrastructure development. Large budget allocations have been made for roads, railways, and digital infrastructure. This will boost the economy and create new employment opportunities. In the long run, the common public is expected to benefit from these initiatives.

Impact of 10 Major Announcements on Common People

The 10 major announcements of Budget 2026 are directly connected to the lives of common citizens. Income tax relief, possible reduction in petrol diesel prices, inflation control measures, farmer welfare schemes, and infrastructure development decisions can give a new direction to the country’s economy. The real impact of these decisions will become clearer in the coming months.

What Will Change After Budget 2026

Overall, Budget 2026 live updates indicate that the government has tried to present a balanced budget. Along with providing relief to the common man, strong emphasis has been placed on development. Now it remains to be seen how quickly and effectively these announcements are implemented on the ground. Budget 2026 can play a significant role in strengthening the country’s economic condition in the coming years.